How to Automate Your Deriv Binary Trading Effortlessly

June 20, 2024In the realm of financial markets, automation has revolutionized trading by offering efficiency, precision, and the ability to capitalize on opportunities swiftly. Automating your Deriv binary trading can streamline your trading activities, reduce emotional bias, and potentially enhance overall profitability. This article explores the steps and considerations involved in automating your Deriv binary trading effortlessly, highlighting the benefits and best practices for traders looking to harness the power of automation.

Understanding Automated Deriv Binary Trading

Automated Deriv binary trading involves using software applications or bots to execute trading decisions based on pre-defined criteria and algorithms. These bots operate independently once configured, analyzing market conditions, identifying trading opportunities, and executing trades without requiring constant supervision from the trader. This automation can significantly reduce the time spent monitoring the markets manually and eliminate emotional trading decisions.

Benefits of Automating Your Deriv Binary Trading

1. Emotion-Free Trading

One of the primary advantages of automated trading is its ability to eliminate emotional bias from trading decisions. Fear, greed, and hesitation often influence manual trading, leading to inconsistent results. Automate Deriv Binary Trading adheres strictly to predefined rules, ensuring trades are executed based on logic and data rather than emotions, which can lead to more disciplined and consistent trading outcomes.

2. Increased Efficiency

Automated trading systems can monitor multiple markets, assets, and trading opportunities simultaneously, something human traders would find challenging to do efficiently. This efficiency allows traders to capitalize on fleeting market opportunities and execute trades promptly at optimal prices, potentially improving overall trading performance and profitability.

3. Backtesting and Strategy Optimization

Before deploying an automated Deriv binary trading strategy in live markets, traders can backtest their algorithms using historical market data. Backtesting allows traders to evaluate the performance of their strategies under various market conditions, identify strengths and weaknesses, and fine-tune parameters for optimal results. This iterative process of strategy optimization can enhance the robustness and effectiveness of automated trading systems.

4. 24/7 Market Monitoring

The financial markets operate around the clock across different time zones. Automated Deriv binary trading systems can monitor market movements and execute trades even during off-hours or when the trader is unavailable. This capability ensures that trading opportunities are not missed due to time constraints and enables continuous monitoring of positions to manage risk effectively.

5. Diversification and Risk Management

Automated trading systems facilitate diversification by enabling simultaneous trading across multiple assets, markets, or strategies. Diversification helps spread risk and reduce exposure to individual market fluctuations. Additionally, these systems incorporate risk management features such as stop-loss orders, position sizing rules, and portfolio rebalancing strategies to protect capital and minimize potential losses.

6. Speed and Accuracy

Automated Deriv binary trading systems execute trades with speed and precision, leveraging algorithmic algorithms to analyze market data and execute orders swiftly at optimal prices. This can reduce latency and minimize slippage, ensuring that trades are executed according to plan and maximizing the efficiency of capital utilization.

Steps to Automate Your Deriv Binary Trading Effortlessly

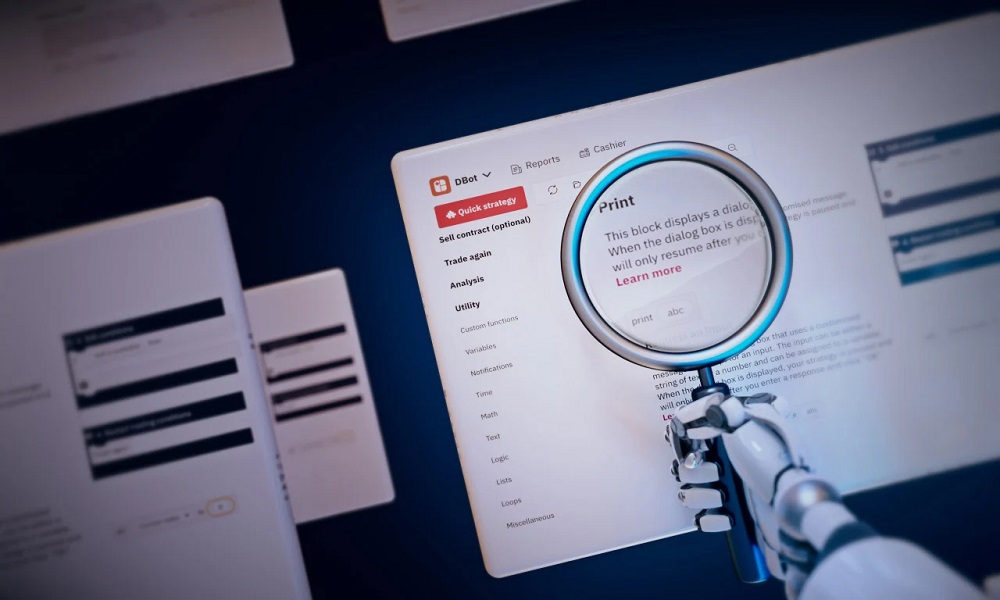

1. Choose a Reliable Trading Platform or Bot

Selecting a reliable trading platform or bot is crucial for successful automation. Ensure the platform offers robust security measures, reliable order execution, and supports Deriv binary options trading. Popular platforms like MetaTrader 4 or specialized bots designed for Deriv trading can be viable options.

2. Define Your Trading Strategy

Before automating, clearly define your trading strategy. Determine the criteria for entering and exiting trades, including indicators, technical analysis tools, risk parameters, and position sizing rules. Your strategy should align with your trading goals, risk tolerance, and market conditions you intend to trade.

3. Backtest Your Strategy

Utilize backtesting tools provided by your chosen platform to test your trading strategy using historical data. Assess the performance metrics such as profitability, drawdowns, win-to-loss ratio, and overall consistency. Adjust parameters based on backtesting results to optimize your strategy before deploying it in live markets.

4. Set Up Automation Parameters

Configure your chosen trading platform or bot to automate your Deriv binary trading strategy. Input the predefined criteria, including entry and exit signals, risk management rules, and any other parameters specific to your strategy. Ensure the automation setup aligns with your backtested results and trading objectives.

5. Monitor and Optimize

Even though automated, regular monitoring is essential to ensure your trading system operates as expected. Monitor performance metrics, review trade executions, and adjust parameters if market conditions or strategy performance deviates from expectations. Continuously optimize your automated trading system to adapt to changing market dynamics and improve efficiency over time.

6. Stay Informed and Adapt

Stay informed about market developments, economic events, and geopolitical factors that may impact your trading strategy. Automated systems excel at executing trades based on predefined rules, but staying adaptable and adjusting strategies as needed based on current market conditions is crucial for long-term success.

Conclusion

Automating your Deriv binary trading can be a game-changer in enhancing trading efficiency, minimizing emotional bias, and potentially increasing profitability. By leveraging automated systems, traders can capitalize on market opportunities swiftly, manage risk effectively, and maintain disciplined trading practices. However, successful automation requires careful planning, strategy development, thorough testing, and ongoing monitoring. By following best practices and continuously optimizing your automated trading system, you can harness the power of automation to achieve your trading goals and navigate the dynamic landscape of Deriv binary options trading with confidence.

- No Comments!